The Week In Markets

Markets are grappling with newfound uncertainty as the countdown to the Federal Reserve’s next interest rate decision approaches. Federal funds futures now indicate a 45% chance of a 50-basis point cut next week, up significantly from 18% the previous day. This shift is driven by reports suggesting that FOMC members are debating between a 25bps or a 50bps rate cut, coupled with signs that the labor market might be tightening—initial jobless claims increased to 230,000, and continuing claims rose to 1.85 million.

Fed Chair Jerome Powell has emphasized the careful timing of rate cuts to avoid further deterioration in the job market, stating, “We do not seek or welcome further cooling in labor market conditions.” In recent history, an initial 50bps cut has preceded economic downturns, occurring twice since 1990—in 2001 and 2007—both times before recessions.

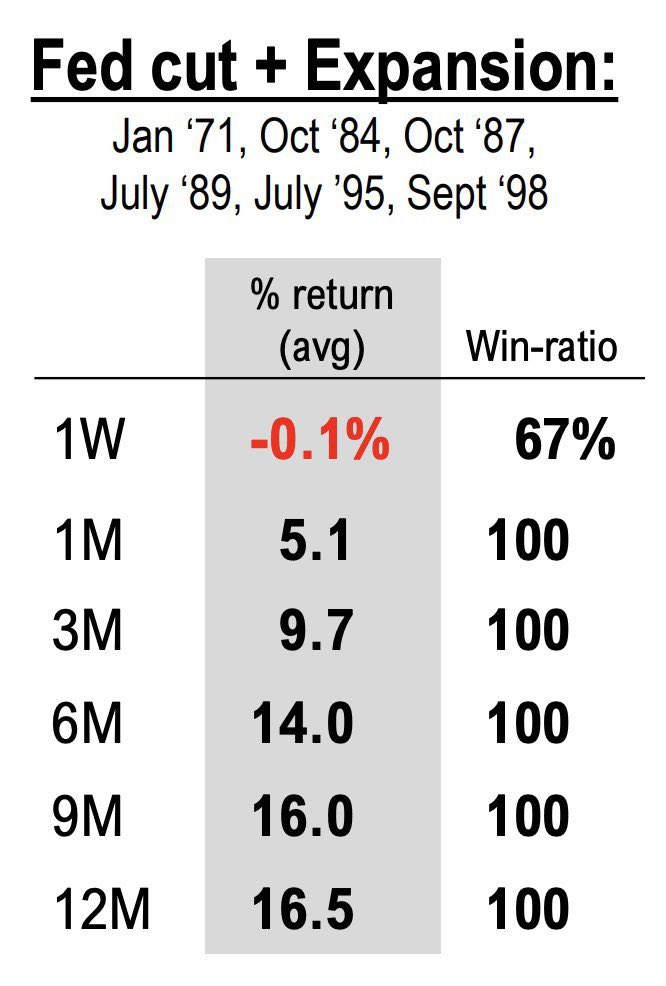

However, an analysis of 10 past Fed "first cuts" reveals a stark difference between scenarios where the economy slid into recession and those with a "no landing" outcome. In the five cases leading to recession (July '74, April '80, January '01, September '07), the S&P 500 experienced negative returns, while in the six "no landing" cases (e.g., January '71, October '84, July '95, September '98), returns were markedly positive, particularly over 1- and 3-month horizons (+5.2% and +9.7% respectively). With the Fed currently cutting rates amid an expanding economy and cooling inflation, this cycle aligns more with a "no landing" scenario. With only three meetings left this year, the upcoming decision could significantly influence market trajectories for the remainder of 2024.

In crypto, Bitcoin ETFs have marked eight months since their U.S. launch, attracting approximately $17 billion—a testament to their unprecedented popularity. However, recent weeks have seen outflows totaling about $1.2 billion, with September surpassing previous months in negative net flows. Despite September’s historical unkindness to Bitcoin and the stock market, industry insiders remain optimistic. Christopher Jensen of Franklin Templeton notes that institutions are increasingly engaging with the asset class, with investment advisers reallocating funds from traditional tech stocks to crypto assets like Ethereum.

The broader crypto industry faces challenges, with sentiments of being “adrift” due to inflated altcoin valuations, low-float launch strategies, and regulatory ambiguities hindering governance tokens. Travis Kling describes a “Pervasive Quiet Quitting” within the market, stemming from disenchantment over the lack of real-world problem-solving and significant adoption in crypto projects. Misaligned incentives in venture capital further erode trust and enthusiasm, as overvalued projects fail to deliver tangible results.

Amidst these challenges, there are glimmers of hope. Upcoming elections may bring new regulatory perspectives, potentially resolving clarity issues and fostering innovation. Progress in areas like stablecoins suggests positive developments are underway. The possibility of redesigning token structures to allow for better value accrual offers a path forward. Navigating through current uncertainties, we continue to believe the industry is on the cusp of the next significant wave of adoption and innovation, it's only a matter of time.

Top Stories

Paypal and Venmo Integrate Ethereum Name Service for Simplified Crypto Payments

Paypal and Venmo have integrated the Ethereum Name Service (ENS) into their platforms, enabling U.S. users to send cryptocurrency by entering readable ENS names instead of traditional, complex wallet addresses. ENS, a decentralized naming system built on Ethereum, simplifies the process by automatically linking these names to wallet addresses, reducing errors and making crypto transactions more user-friendly. Previously, users had to manually input, paste, or scan external wallets to transfer funds. According to ENS Labs, this feature will first be available to U.S. users, marking an important step in bridging the gap between decentralized finance and mainstream platforms like Paypal and Venmo. By incorporating ENS, these payment giants are enhancing accessibility for crypto users who may prefer familiar Web2 environments. With over 2 million ENS names registered on-chain and 4 million off-chain, this integration is a significant move in expanding crypto's reach. Paypal and Venmo have supported cryptocurrencies since 2021, and this update further simplifies crypto management for their user base.

Friend.Tech Shuts Down as Developers Renounce Control of Smart Contracts

Friend.Tech, a Web3 social network that gained rapid popularity in 2023 by allowing users to trade tokens for access to influencer feeds, has effectively shut down after its developers renounced control of its smart contracts. Launched on Coinbase’s Base network, the platform initially saw significant success, surpassing Ethereum's daily earnings and generating over $20 million in fees at its peak. However, after an underwhelming launch of Version 2 and a failed token airdrop, user interest dwindled, and trading activity slowed significantly. On September 8, the developers transferred control of the platform’s smart contracts to Ethereum’s null address, preventing further updates or takeovers, signaling the platform’s likely end despite technically remaining functional. See more: Friend.tech Founders Pocket $44MM, Shut Down Project

Ethereum's Revenue and Ecosystem Face Challenges Amid Long-Term Growth Strategy

Ethereum is currently facing a challenging period, marked by a 99% drop in revenue over the past six months, declining from a peak of $36 million daily in March to just $199K per day in August. Additionally, criticisms of Ethereum’s foundation, Vitalik Buterin’s comments on DeFi sustainability, and a 22% price drop in August have further compounded the platform’s struggles. Despite these setbacks, Ethereum’s long-term strategy remains focused on its evolution into the core of the DeFi ecosystem, a process initiated by The Merge and enhanced with the Dencun upgrade in March 2024, which reduced transaction fees and boosted Ethereum Layer-2 (L2) networks. While these L2s, such as Base and Optimism, are thriving, not much of their value is returning to Ethereum’s mainnet, raising concerns about Ethereum’s business model. Critics, including Solana’s Anatoly Yakovenko, argue that L2s are "parasitic," while others question Ethereum’s $275 billion valuation. However, Ethereum developer Dankrad Feist remains optimistic, emphasizing that high-value transactions will continue to occur on Ethereum L1, benefiting from the symbiotic relationship with L2s.

Bitcoin Miner Revenue Faces Pressure as Transaction Fees Plunge

Bitcoin miners are experiencing financial strain as block subsidies now account for almost all of their income. On September 13, 2024, only 1.6% ($398,860) of daily revenue came from transaction fees, a stark contrast to earlier periods when fees made up more than 40% of revenue. This shift highlights the increasing dependence on block rewards, which were recently halved to 3.125 BTC, further squeezing miners' income. The decline in fee revenue is largely due to the cooling interest in trends like Ordinals and Runes, which had temporarily boosted on-chain activity and miner profitability. As block subsidies continue to halve every four years, the need for transaction fees to secure the network will grow, raising questions about the sustainability of Bitcoin’s security model. Proposals to increase block sizes or encourage layer-2 solutions may play a crucial role in shaping the future of Bitcoin mining and the network’s overall health.

Solana Fees Hit 2024 Low Amid Decline in Memecoin Activity

Solana’s transaction fees have dropped to their lowest levels of 2024 as the memecoin frenzy that boosted the network earlier this year subsides. On September 12, Solana recorded just $146,411 in transaction fees, a significant decline from its March high of $5.08 million. The average transaction fee has also fallen, hitting $0.0053 on September 7, the lowest in six months. The decrease in activity on PumpFun, a popular memecoin launchpad, is a primary factor in Solana's declining fee revenue. New token deployments on PumpFun dropped 77.6% from August highs, and decentralized exchange (DEX) volumes related to the platform fell 81.7% since June. Rival networks, like Tron’s SunPump and Ethereum’s EtherVista, have also launched their own memecoin platforms but have similarly struggled to maintain momentum.

Regulation

Bitcoin Sinks After Presidential Debate Ignores Crypto Regulation

Bitcoin dropped by 1.5% to $56,500 following the U.S. presidential debate between Vice President Kamala Harris and former President Donald Trump, which notably omitted any mention of cryptocurrency regulation. The lack of clarity on digital assets left crypto markets in uncertainty, causing Ethereum, Solana, and Dogecoin to fall as well. Despite this, institutional interest in cryptocurrencies remains strong, with spot Bitcoin ETFs seeing significant inflows. While Trump’s stance on crypto has evolved, with pro-Bitcoin comments and plans to make the U.S. a global crypto hub, Harris has maintained a more cautious approach.

Crypto Involved in 87% of All Investment Fraud in 2023, Says FBI

In 2023, cryptocurrency-related scams drove 87% of all investment fraud in the U.S., leading to losses of $3.96 billion out of a total $4.57 billion, according to the FBI's latest report. This marks a significant rise from previous years, with 2022 losses at $3.3 billion and a massive jump from $253 million in 2018. The number of victims surged as well, with complaints increasing from 3,693 in 2018 to 39,570 in 2023, and an average loss per victim rising to $115,499. Millennials and Gen X were the most frequently targeted groups, though all age ranges saw impacts. The FBI also flagged evolving hacker tactics, such as North Korean campaigns targeting Bitcoin ETF issuers and "pig butchering" scams, where fraudsters exploit fake romantic relationships to trick victims into investing in fraudulent crypto schemes. California residents faced the highest financial losses, while Maryland had the highest rate of victims. The report advises caution, skepticism, and consulting licensed financial advisors to avoid falling prey to such scams.

Recent Crypto Firm Settlements Highlight Custody and Compliance Failures

In recent weeks, three major crypto firms—Robinhood Markets, Galois Capital, and Uniswap Labs—settled legal actions with U.S. government agencies, all relating to issues around custody and adherence to laws or company policies. Robinhood paid the largest settlement at $3.9 million to the California Department of Justice for preventing crypto withdrawals between 2018-2022, violating state commodities laws. The company was also found to have misled customers about having custody of their assets. Galois Capital settled with the SEC for $225,000 for failing to comply with the Custody Rule, as they kept assets on unregulated platforms like FTX and misled investors about redemption policies. Uniswap Labs paid $175,000 to the CFTC for offering illegal commodities transactions without proper registration, while also facing an ongoing SEC investigation over potential unlicensed securities operations. All firms settled without admitting wrongdoing.

Coinbase Launches cbBTC Amid Wrapped Bitcoin Controversy

Coinbase has begun rolling out its new wrapped Bitcoin token, cbBTC, enabling users to utilize Bitcoin within Ethereum and Base’s DeFi ecosystems. Backed fully by Bitcoin held by Coinbase, cbBTC is available to customers in several countries, excluding New York State. The launch comes as Coinbase aims to capitalize on the recent controversy surrounding Wrapped Bitcoin (WBTC) after BitGo announced changes to its ownership structure, including a partnership with Tron’s founder, Justin Sun. Critics have raised transparency concerns over WBTC, while Sun has responded by questioning the regulatory risks of cbBTC. Coinbase is positioning cbBTC to support decentralized financial apps, with integrations on major protocols such as Aave, Compound, and Curve.

Other Domestic Regulation Updates

- Trump Announces Launch of World Liberty Financial: ‘We’re Embracing the Future with Crypto’

- Tether Made More Money Than BlackRock Last Year

- Bitcoin Sinks After Trump and Harris Leave Crypto Out of Presidential Debate

- Grayscale Debuts XRP Trust Following Bitcoin and Ethereum ETF Launches

- eToro Will Only Offer Bitcoin, Ethereum, and Bitcoin Cash in US After Settling SEC Charges

Other International Regulation Updates

- Russian Business Group Urges Unfettered Use of Crypto, Stablecoins in Foreign Trade

- LayerZero to Provide Interoperability for BitGo’s WBTC

- Japan May Drop Crypto Tax Rate From 55% to 20%

Pain & Gain

Pain

- Monero Expert Fact Checks Chainalysis Video Claiming XMR Transactions Can Be Traced

- TON Forecasts Outages As Hamster Kombat and Catizen Airdrops Loom

- Coinbase Holds 11% of Bitcoin’s Total Supply – How Worried Should We Be?

- Institutions Sold $726 Million of Crypto Last Week, Highest Since March

- Cosmos Foundation Receives No Confidence Vote Over Mismanagement of Funds

Gain

- Japan's Metaplanet buys additional $2 million in bitcoin, raising total holdings to $26 million

- MicroStrategy Just Bought Another $1.1 Billion Worth of Bitcoin

- Multi-Million Dollar CryptoPunk NFT Sells for 10 ETH

- MicroStrategy buys additional 18,300 bitcoin for $1.1 billion, taking holdings to 244,800 BTC

- Tether Invests $100MM in Agriculture Firm Tokenizing Grains

Important Legal Notices

This reflects the views MJL Capital LLC (“MJL”), but it should in no way be construed to represent financial or investment advice. Nothing in this correspondence is intended to constitute or form part of, and should not be construed as, an issue for sale or subscription of, or solicitation of any offer or invitation to subscribe for, underwrite, or otherwise acquire or dispose of any security, including any interest in any private investment fund managed by MJL. Any such offer may only be made pursuant to a formal confidential private placement memorandum of any such fund, which may be furnished to potential investors upon request and which will contain important information to be considered in connection with any such investment, including risk factors associated with making any investment in any such fund. Further, nothing in this correspondence is, or is intended to be treated as, investment or tax advice. Each recipient should consult their own legal, tax and other professional advisors in connection with investment decisions.

Domenic Salvo is a Managing Partner at MJL Capital, helping lead Portfolio Research and Investor Relations.