The Week In Markets

The US Economy continues to walk a tightrope between recession fears and hopes for a soft landing with market sentiment swinging wildly – one moment, strong retail sales spark optimism, and the next, a downturn in the housing market rekindles concerns about an impending recession.

Liquidity remains crucial, with central banks keeping the money flowing. Despite the recent volatility seen in equity markets, the bond market doesn't seem to be flashing any major warning signs of a credit crisis, suggesting we're likely still in a bullish liquidity cycle. Unlike the increasingly systematic, passive-driven equity markets, the bond market, which is still largely driven by active managers, often offers a clearer picture of where the economy might be headed.

As the week unfolds, all eyes are on Jerome Powell ahead of the Jackson Hole Summit. The question on everyone’s mind is whether he will provide the market with the reassurance it craves or add fuel to the existing uncertainty. Rate cut sentiment hit its peak on August 5th amid a chaotic market selloff, with markets almost fully pricing in a 50 basis point cut by the September 18th FOMC meeting and around 115 basis points of cuts by year-end. While expectations have moderated, Fed fund futures still indicate at least one 25 basis point cut in September and nearly 100 basis points of cuts by year-end.

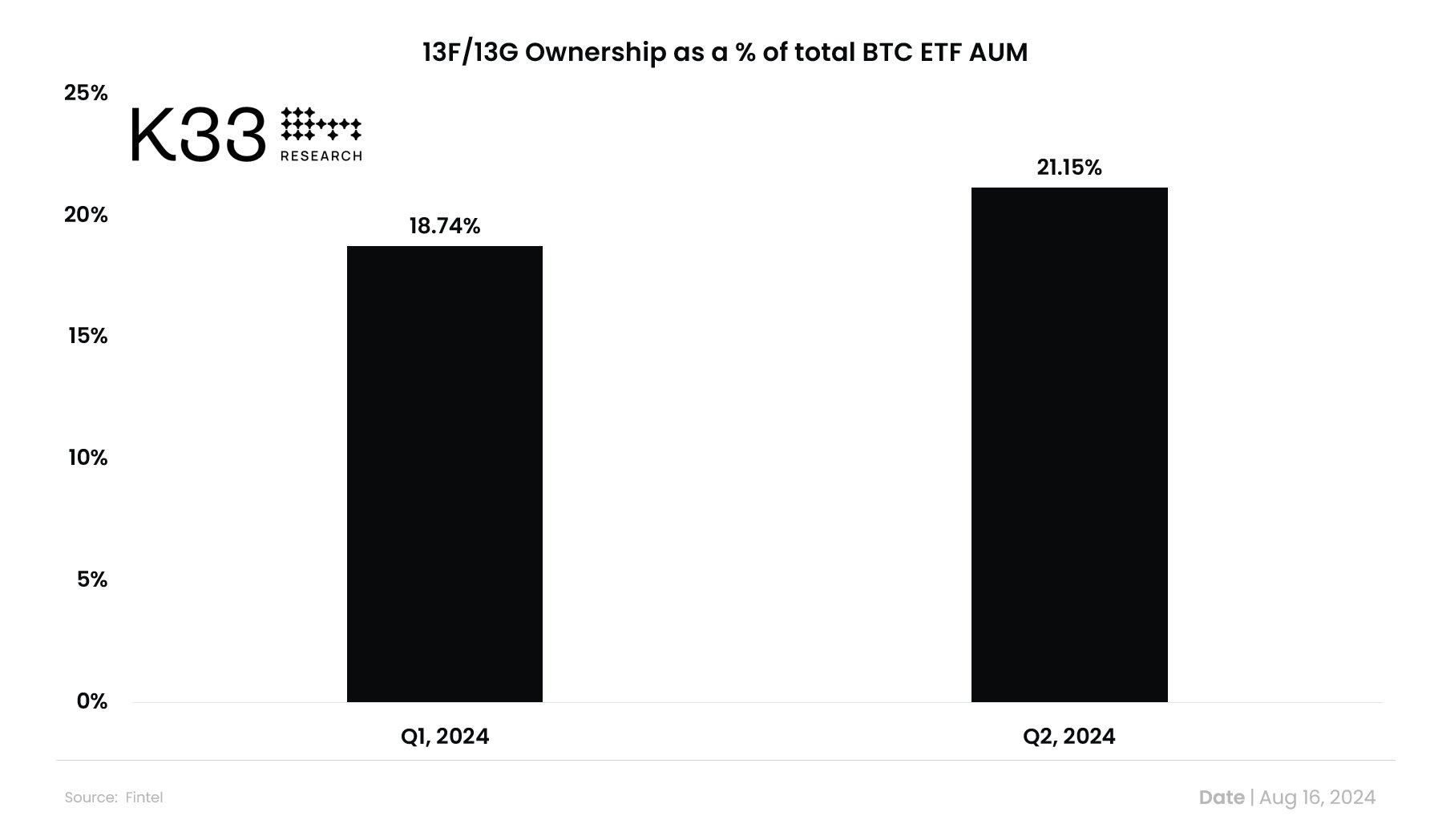

In the crypto markets, particularly in assets with low float and high fully diluted valuation (FDV), the environment remains challenging. ETF demand has yet to rebound to levels seen during other recent dips like we saw in July, suggesting broader interest in crypto, particularly through traditional investment channels, has yet to fully materialize. Despite the stalling ETF flows in the aggregate, recent 13F filings reveal that prominent institutional investors, including the likes of Paul Tudor Jones, are adding exposure to crypto via the ETFs.

Given that we're currently in the aftermath of one of the largest volatility events in recent years, it will likely take time and consolidation before crypto markets will see sustained upward trajectories. However, periods of high volatility and forced liquidations have historically set the stage for significant opportunities, and we see no reason why this time should be any different – it's only a matter of time.

Top Stories

Ethereum Transaction Fees Hit 4-Year Low Amid Market Shift

On August 16, 2024, the average transaction fee on the Ethereum network dropped to $1.47, its lowest since November 2020, reflecting a nearly four-year low. This decline coincides with a period of reduced on-chain activity and a shift in market focus toward other Layer 1 blockchains like Solana. Despite this downturn, the drop in transaction fees is noteworthy as it demonstrates Ethereum’s improved efficiency. The network now maintains low fees even with a more developed ecosystem, a larger user base, and an ETH price over five times higher than in 2020, when ETH was around $460. Interestingly, the last time fees were this low, Ethereum experienced a significant market uptrend, with ETH's price surging by over 10x in the following year.

Source: The Block

MakerDAO Considers Offboarding WBTC Amid Concerns Over Management Restructure

MakerDAO is deliberating on whether to stop allowing Wrapped Bitcoin (WBTC) as collateral for minting its DAI stablecoin. This follows BitGo's announcement of a new joint venture that will shift control of WBTC to BiT Global and Justin Sun’s Tron ecosystem. The proposal, put forward by BA Labs, a web3 risk analysis team, expresses concerns over Justin Sun's involvement due to previous issues with transparency and operational practices in his projects. The recommendation suggests lowering the WBTC debt ceilings to 0 DAI and halting new borrowing against WBTC. The MakerDAO community is divided; some support the cautious approach, while others feel the reaction is excessive. This decision could have far-reaching implications for DAI’s collateral system and the broader DeFi ecosystem. See similar: Coinbase Teases cbBTC Amid Wrapped Bitcoin Drama

Web3 Gambling Surges with $79B Wagered in Crypto Over Four Years

Web3 gambling has rapidly gained traction, with nearly $79 billion wagered in crypto over the past four years. The appeal lies in enhanced transparency and reduced reliance on intermediaries, leading to lower fees and minimized third-party risk. Users can confirm bets directly through their crypto wallets, keeping funds secure until outcomes are determined, with instant transfers of winnings or losses. Platforms like Polymarket, which focuses on political event betting, have become prominent, raising $70 million earlier this year and exceeding $1 billion in volume, despite facing regulatory challenges in the U.S. The sports betting sector is also thriving, valued at nearly $60 billion and projected to grow over 10% annually. However, Web3 gambling faces risks, including regulatory scrutiny and potential money laundering issues, particularly as incidents involving founders misappropriating funds for gambling arise. See similar: Polymarket sees largest single-day decline in open interest

Apple’s NFC Update Set to Enable USDC Tap-to-Pay on iPhones

Circle CEO Jeremy Allaire announced that Apple's recent NFC upgrade will pave the way for USDC Tap-to-Pay functionality on iPhones. Following Apple's decision to allow third-party applications to utilize its NFC technology, wallet developers are encouraged to prepare for this new payment option. Although Circle does not have a direct partnership with Apple, the upcoming iOS 18.1 update will enable alternative payment systems to compete with Apple Pay. Allaire explained that USDC Tap-to-Pay will allow seamless transactions via iPhones, where wallet apps can use NFC to exchange payment information with point-of-sale systems. This innovation will enable direct USDC payments to merchants and could extend to other digital assets, such as NFTs and stablecoins like EURC. Allaire urged developers to integrate the latest iOS SDKs to get ready for the launch of this feature.

Regulation

Schumer and Harris Camp Highlight Bipartisan Efforts for Crypto Regulation

Senator Chuck Schumer (D-NY) committed to passing crypto legislation by the end of the year during the Crypto4Harris town hall, emphasizing the need for regulation to prevent crypto activities from moving to countries with lax laws. The event showcased bipartisan support for crypto, with voices like investor Anthony Scaramucci and Rep. Wiley Nickel (D-NC) advocating for a unified approach and cautioning against politicization. Meanwhile, Vice President Kamala Harris's campaign is actively seeking to engage with the crypto industry, as noted by Circle CEO Jeremy Allaire, who pointed out the campaign's efforts to understand key issues. Despite some signs of openness, including inquiries from her team to crypto leaders like Mark Cuban, Harris has yet to publicly clarify her stance on digital assets, leading to uncertainty about her future policy direction as she gains traction among voters. See similar (but different): Former President Trump has brought Cantor Fitzgerald CEO Harold Lutnick aboard as the co-chair of his transition team in anticipation of victory in November’s election. In addition to leading one of the biggest firms on Wall Street, Lutnick is a fan of Bitcoin—and spoke at Bitcoin 2024 in Nashville last month.

Regulatory Pressure on Crypto-Friendly Banks: Customers Bancorp Under Fire

Customers Bancorp, a major provider of banking services to the U.S. crypto industry, has become the latest target of regulatory enforcement. The Federal Reserve's action, disclosed on August 8, 2024, cited significant deficiencies in the bank's risk management and anti-money laundering (AML) processes. In response, Customers Bancorp has agreed to overhaul its Bank Secrecy Act (BSA) and AML procedures, appoint new compliance officers, and submit to an independent review of its transaction monitoring. The move is seen by crypto advocates as part of "Operation Choke Point 2.0," a perceived coordinated effort by U.S. regulators to isolate the crypto industry from traditional banking. This action follows a pattern of increasing scrutiny on banks serving crypto firms, with critics claiming it reflects a broader crackdown on the sector. Customers Bancorp's stock price dropped nearly 17% following the announcement.

Stablecoin Market Growth Signals Rising Interest in Digital Assets

The stablecoin market has experienced significant growth, indicating increased interest in digital assets following the introduction of U.S. crypto ETFs. With stablecoins primarily used for transactions between crypto and fiat, their performance reflects market sentiment. Since the end of 2023, the market cap has surged by 26.9%, climbing from $130 billion to $165.7 billion. Notably, activity levels have emerged as a leading market indicator. For instance, data shows that $1.3 billion of USDT transferred from Tether to centralized exchanges after Bitcoin's price dip on August 5, suggesting that major investors are positioning themselves to capitalize on potential gains. Tether remains the dominant player, boasting a market cap of $115.7 billion and substantial profits. Companies like Ripple are entering the market, predicting growth to $2 trillion by 2028. Despite the optimism, regulatory hurdles and calls for improved transparency pose ongoing challenges for the industry.

Source: DefiLlama

Celsius Sues Tether Over Bitcoin Liquidation Amid Bankruptcy Proceedings

Defunct cryptocurrency exchange Celsius has filed a lawsuit against Tether, alleging the misappropriation of assets and seeking approximately $3.5 billion in Bitcoin returns, damages, and legal fees. The lawsuit centers around a $2.4 billion Bitcoin loan, where Celsius provided 39,542.42 BTC as collateral for a loan in Tether's USDT stablecoin during Celsius’ bankruptcy. As Bitcoin's price dropped, Celsius claims it was required to provide additional collateral to avoid liquidation. However, the lawsuit alleges that Tether liquidated the Bitcoin collateral at a price that covered the debt without allowing Celsius the chance to provide further collateral, leading to significant losses for Celsius. The legal battle now focuses on whether Tether's actions were justified or if they breached the terms of their agreement.

Other Domestic Regulation Updates

- SEC charges NovaTech with allegedly operating a pyramid scheme that raised $650 million in crypto

- Harris takes lead over Trump on Polymarket’s $572 million prediction market for next US president

- Coinbase Urges SEC to 'Abandon' Its 'Irrational' DeFi Exchange Rule

- Crypto executives meet White House officials to discuss policy, grievances during virtual roundtable

- Ripple Ordered to Pay $125MM, a Fraction of Penalty SEC Sought

Other International Regulation Updates

- Crypto.com, Gemini join Coinbase in opposing CFTC proposal that could ban prediction markets

- BitGo Obtains Major Payment Institution License in Singapore

- Singapore’s DBS Bank Launches Ethereum-based Treasury Solution

- Pump.fun attacker Jarett Dunn could face more than seven years in jail after pleading guilty to siphoning $2 million worth of Solana from the platform

Pain & Gain

Pain

- How a Sports Brand Used Fake Celebs to Pump an 'Insane' Cryptocurrency

- Meme coin factory Pump.fun was flooded with 10,000 new tokens in a three-hour period following the launch of the “Pump.fun Olympics”

- Bitcoin Miners At ‘Max Pain’ As Experts Reckon Bottom Is In

Gain

- Optimism Plans To Unlock Superchain Interoperability Next Year

- Goldman Sachs Holds The Most Bitcoin ETF Shares Among US Investment Banks

- Ethereum Bounces as Grayscale’s Ether ETF Posts First Daily Inflow

Important Legal Notices

This reflects the views MJL Capital LLC (“MJL”), but it should in no way be construed to represent financial or investment advice. Nothing in this correspondence is intended to constitute or form part of, and should not be construed as, an issue for sale or subscription of, or solicitation of any offer or invitation to subscribe for, underwrite, or otherwise acquire or dispose of any security, including any interest in any private investment fund managed by MJL. Any such offer may only be made pursuant to a formal confidential private placement memorandum of any such fund, which may be furnished to potential investors upon request and which will contain important information to be considered in connection with any such investment, including risk factors associated with making any investment in any such fund. Further, nothing in this correspondence is, or is intended to be treated as, investment or tax advice. Each recipient should consult their own legal, tax and other professional advisors in connection with investment decisions.

Domenic Salvo is a Managing Partner at MJL Capital, helping lead Portfolio Research and Investor Relations.